New Case Study: How XpressConnect Personalizes Outreach to 70,000 Contacts in Pipeline CRM!

New Case Study: How XpressConnect Personalizes Outreach to 70,000 Contacts in Pipeline CRM!

Turning down poor-quality leads isn’t a crime. It’s a smart and strategic decision that can prevent you from having higher customer acquisition costs (CAC), dealing with predatory customers, missing lucrative opportunities, and more.

Discover what high-quality leads entail, their impact on your business, and how to define them.

Free CRM Guide

Lead quality is something that’s preached consistently in sales. Everyone knows that lead quality is important, but that fails to make a measurable impact when crunch time hits. When a negative triggering event occurs, lead discipline goes out the window.

Crises that impact lead quality:

The consequences of poor lead quality include:

High-quality leads aren’t nice-to-haves; They’re an essential component of the sales pipeline. The more you prioritize this, the easier it is to convert quality leads into well-paying customers.

A quality lead is a qualified lead. Lead quality is an indicator; it answers the following questions.

“Is this prospect likely to become a customer? What’s the likelihood they’ll make a purchase?” When it comes to qualified leads, it’s all about degrees.

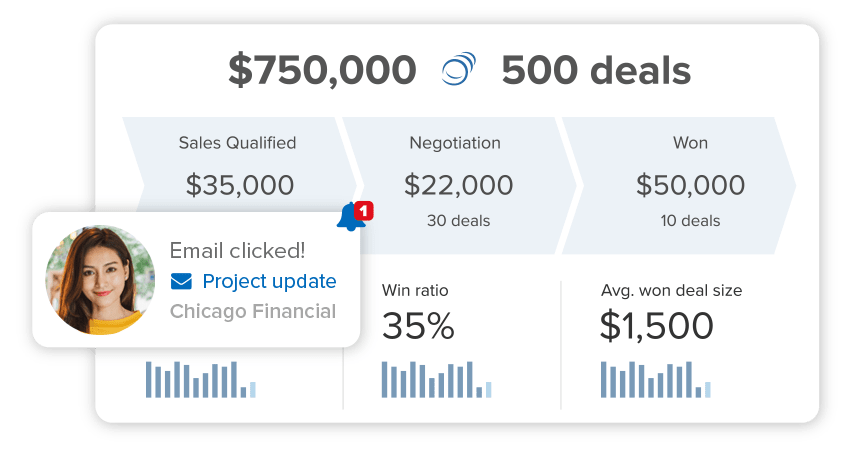

This is a general overview of contacts in your pipeline, but it’s a necessary place to start.

At the macro level, qualified leads are prospects who are willing, able, and ready to buy. These prospects display many of the characteristics that are present in an ideal customer. They’ve shared their contact information with your company, requested information, and expressed an appropriate level of interest in getting the relationship started.

At the meso level, we have marketing qualified leads (MQLs). These prospects have provided the appropriate behavioral cues and outcome markers. These cues and markers signal intent showing marketing teams that they want to purchase. These cues and markers include actions that signal conversion intent:

MQLs are a great indicator of lead quality because they’re based on action.

At the micro level, we have sales qualified leads (SQLs).

Gartner describes SQLs as “a prospective customer who has moved through the sales pipeline – from marketing-qualified lead through sales-accepted lead – to a position where the sales team can now work on converting them into an active customer.”

What does this mean?

Your customer has signaled that they’re interested in making a purchase, and they’re ready to negotiate with a member of the sales team. If your leads have undergone this three-step qualification process, they’ve self-identified.

They’ve stated, via behavioral cues and outcome markers, that they’re a high-quality candidate.

This is what you need.

If your leads make it to this point, it’s safe to say that you have a quality lead.

But why?

What specifically is a quality lead? How do you define or measure that quality?

It’s about identifying your lead sweet spot.

Remember how we approached this from the macro, meso, and micro levels? That’s the same approach we’ll need to take here. To define a quality lead, we’ll start by asking four questions.

These questions are intentionally broad.

They’re designed to create an internal conversation about the kinds of criteria your MQLs and SQLs need to meet consistently. Let’s take a more in-depth look at these questions.

Marketing should have a clear sense of the demographics, psychographics, firmographics, and ethnographics of a prospect who’s willing, able, and ready to buy. Sales should have a clear sense of the steps customers need to take to earn their place in the sales pipeline.

Both groups should be able to identify important red flags (e.g., knowledge vampires, tire kickers, discount/price shoppers).

You should have a clear idea of your breakeven cost-per-lead. If your monthly marketing budget is $5,000 and you receive 100 leads, your cost-per-lead is $50. If you’re selling a product that’s $150, that’s probably pretty affordable.

What if you’re selling a product that’s $45?

Well, that’s obviously not going to work now, is it? Your sales and marketing teams need to know what your breakeven cost-per-lead is.

Here’s why.

Assessing lead quality is straightforward when you know your breakeven cost-per-lead. If your breakeven cost-per-lead is $50, your product retails for $60, but your customer is demanding a 50% discount, you don’t have a quality lead.

Your prospects have specific expectations from you. These expectations come in five distinct categories.

These are the expectations customers have.

The better you are at clarifying these expectations upfront during the sales process, the easier it will be to attract and convert new customers.

Remember the 3% rule?

In a previous blog post, we mentioned that only 3% of your customers are ready to buy.

This means 97% percent of your customers are not ready to buy. Here’s a quick recap of the 3% rule.

The 3% Rule shows you how to spend your sales team’s attention and time.

Here’s a breakdown you can use to quickly assess lead quality.

What does this mean, then?

It means that, on average, 40% of your prospects are interested in making a purchase decision at some point. Using this response protocol, we see that most of your leads will require consistent nurturing/follow-up.

When it comes to measuring lead quality, there are a few ways to measure it. Here are some steps you can take to measure the quality of your leads.

Can you see what’s happening?

Measuring lead quality enables you to look forward and reason backward. You can identify the lead criteria you need to generate revenue and growth for your company.

High-quality leads aren’t simply a nice-to-have; it’s an essential component of the sales pipeline.

The more you prioritize this, the easier it is to convert quality leads into well-paying customers.

As we’ve seen, 40% of leads are poor-quality leads. These leads create revenue leaks, stealing revenue and opportunities from your business. Most businesses are starved for lead and find it difficult to turn down a bad lead.

Use this guide to measure lead quality and boost sales by 15-50%.

Pipeline helps 18,000+ companies like yours decrease time-to-close, increase productivity by 50% or more, and 10x sales. Let us show you how Pipeline can help you win more customers and deals.

See How Pipeline CRM Can Work For You

sales@pipelinecrm.com

Site links