A recent study found that 73% of consumers expected their financial institutions to “anticipate their needs,” but only 37% did. Clients hate high-pressure sales; it’s an immediate turn-off, and this approach creates negative outcomes and long-term relationship problems.

Could an SMS sales strategy be the answer?

Today, we’ll discuss text messaging and its integration with CRM for financial services. I’ll share important information on how to use SMS for sales outreach and maximize sales-qualified leads and deals.

Let’s dive in.

Why You Need SMS for Financial Services Sales Outreach

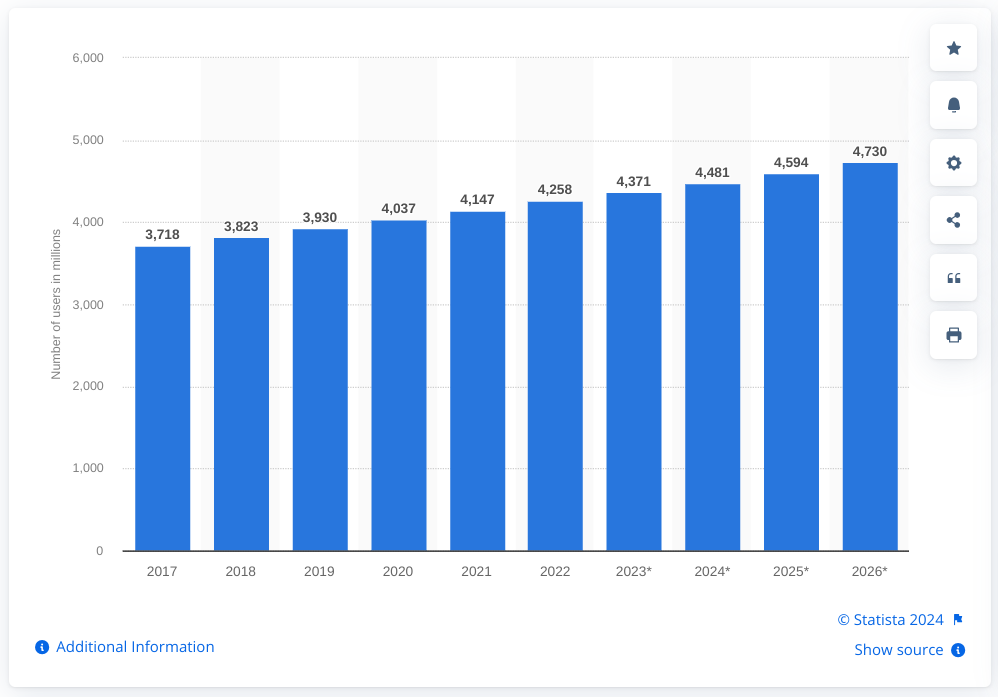

The death of email has been repeatedly predicted over the years. However, Statista has shown the direct opposite. “In 2022, the number of global e-mail users amounted to 4.26 billion and is set to grow to 4.73 billion in 2026.”

If email as a platform has grown, why do we need SMS as a marketing channel? Can’t we just stick with email, such as an email drip campaign, since more people are using it and the channel is growing?

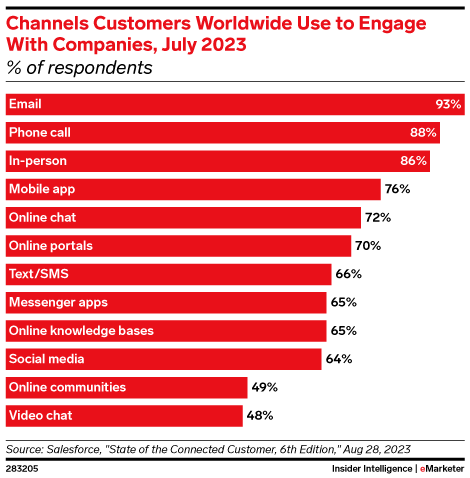

When you look at the data, email seems to be the main way clients engage with brands.

Text/SMS is seventh on the list. Doesn’t this mean that SMS doesn’t perform as well as email? It’s certainly a reasonable conclusion if we look at the charts above. However, if you look closely at the data, SMS tells us a different story.

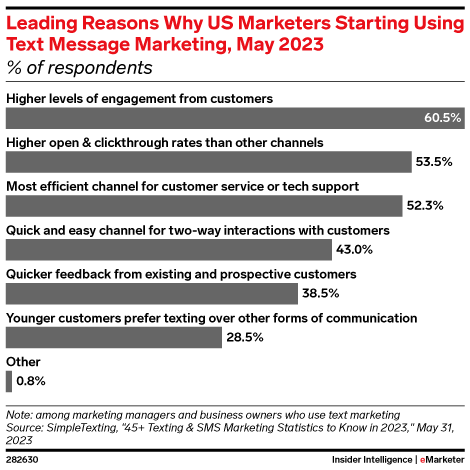

The research shows that SMS has higher levels of engagement from clients and higher click-through rates, as well as offers a two-way interaction with clients. The benefits of using SMS as a part of your sales outreach make even more sense when you realize that:

- 97% of Americans own a smartphone of some kind

- 98% of mobile users will read a branded or business-based SMS message

- Text response rates are as high as 45% to 98% (email averages 2-20%)

What about your clients? What’s their preference?

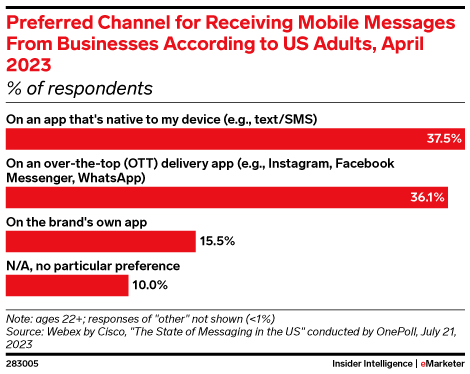

Your clients prefer to use apps already native to their devices—most don’t want to use an unfamiliar app. Since most of us carry our mobile phones, it’s easy to understand why the response rates are so high. So, should financial services focus on SMS for sales outreach?

It’s not an either/or situation; it’s about leveraging SMS and email unique benefits.

According to a recent report, email and SMS serve different purposes. Consumers rely on SMS for:

- Incentives, offers, and deals (e.g., mortgage rates are at a 60-year low)

- Personal alerts (e.g., low balance, account updates, notifications, etc.)

- Personalization and staying in the loop (e.g., the IRS has just changed the rules again)

- Quick access to information (e.g., consumers don’t want to visit brand website/app for information)

On the other hand, email is used to:

- Indoctrinate, segment, and win back clients CRM

- Educate, inform, and persuade clients with, for instance, meaningful content

- Offer incentives (e.g., irresistible offers, discounts, coupons, deals, etc.)

- Sell products and services

- Request feedback, action, or advice

Both email and SMS can be used to send broadcast messages and autoresponder sequences, which are great for generating leads, attracting clients, and closing deals. Therefore, you can and should use both to grow your financial service business.

Pro tip: If you’re struggling to increase your email performance, you may want to check out these 13 common mistakes in email marketing.

The Rules of Using SMS Services

Before we discuss the best practices for leveraging SMS services for sales outreach, we must cover the basics.

In the United States, SMS is governed by five federal and industry watchdogs:

- Federal Communication Commission (FCC): This is an agency of the United States government that regulates communications by radio, television, wire, satellite, and cable across the United States.

- Federal Trade Commission (FTC): The FTC is an independent agency of the United States government that enforces civil antitrust law and promotes consumer protection.

- The Telephone Consumer Protection Act of 1991 (TCPA) spawned the National Do Not Call Registry. It was created to control mobile communications. Companies must adhere to strict solicitation rules and the rules of the Do Not Call Registry.

- Mobile Marketing Association (MMA): A non-profit, globally recognized mobile trade association comprising over 800 member companies from nearly 50 countries.

- CTIA — The Wireless Association: This is a trade association that represents the wireless communications industry in the United States.

If you’re going to use SMS for marketing, you’ll want to follow the rules and guidelines laid out by these organizations. Here’s a summary:

- You need express, written consent to send SMS messages to prospects and clients. This means no old or rented lists.

- Buying or obtaining a prospect’s phone number is not the same as requesting permission from them.

- If you’re advertising (selling), you must provide full disclosure to individuals (e.g., describe your program, message frequency, terms, policies, stop/help, opt-out info, and carrier costs). One example would be opt-out mechanisms, e.g., text STOP to unsubscribe.

- You can’t require an individual’s consent as a condition of purchasing anything.

These rules act as a guardrail to protect consumers from abuse or fraud. Sharing these details will make more sense once we go into the specific steps you can take to work with clients.

Now, Here’s how you can use SMS for sales outreach.

How to Use SMS Platform and CRM for Financial Services

Step 1: Earn the Opt-in

The first step in any SMS campaign is earning the coveted opt-in from clients. There are three main ways you can do this.

- Clients can text a keyword or number to your SMS platform directly (e.g., keywords: REWARDS or a shortcode: 1022). This serves as proof of their opt-in.

- Clients fill out a form on your landing page to opt in (remember the above rules). Depending on your SMS provider, you may be responsible for storing opt-ins on your landing pages as proof of written consent.

- Clients fill out a paper document and choose to opt in. As with the landing pages, you may need to store their opt-ins as proof of consent. This may vary based on your SMS providers.

With each option, you have single, double, or soft opt-ins. Single opt-ins mean your client opts in with no confirmation. Double confirmation means you ask and then confirm that clients want to receive your messages. A soft opt-in means you offer your email list the chance to opt-in to your SMS list.

That said, with SMS for sales outreach, you’re on the clock. Your opt-ins will expire automatically after a period of inactivity.

- Standard rate campaigns: These opt-ins, which don’t charge subscribers a fee outside of standard data and message rates, expire after 18 months.

- Premium rate campaigns: These are campaigns your clients pay you to join, which expire after six months.

If you haven’t sent a message to your subscribers in that timeframe, your campaign is “inactive.” You’re no longer allowed to contact your subscribers or transfer them from one messaging provider to another. In some jurisdictions, there is no expiration date.

Step 2: Define Your SMS Strategy

You can take several approaches to SMS sales outreach. You can use specific tactics or mix and match these as needed.

- Classic outreach: Direct messaging and conversation via text.

- SMS autoresponders: Sending an automatic response to prospects.

- Notify/update prospects via SMS: Sharing updates with prospects/clients about new products, services, etc.

- Client updates re: changes: Keep clients in the loop about changes in laws, regulations, taxation, and compliance requirements.

- Client/advisor check-ins: Sending clients updates on key milestones as they move through the sales pipeline.

- Client support via SMS: Giving clients direct, 1:1 support via text when they call on you

- Information gathering/requests: Request additional information and specifics from clients before, during, and after the sales process.

- Request/offer feedback via SMS: Requesting testimonials, reviews, and general feedback in an intimate setting.

This defining process is essential because it shows you the content you’ll need.

Step 3: Create SMS Message Templates

So, you’ve defined your text/SMS approach. Now, it’s time to create messages that you can use to simplify your sales outreach efforts. As a general rule, there are three types of SMS campaigns: promotional, transactional, and conversational campaigns. The templates below can be used with all three.

Classic SMS Outreach Templates

- [First Name], my name is [Salesperson], and I’m a [Title] at [Company]. Here’s what you can expect from me in the next # days.

- You mentioned that you’re looking to accomplish [Goal]. Here’s what you can expect from me in the next # days.

- We put together a plan to help you achieve [Goal] in ##% less time. Would you be available to chat?

- You mentioned using [Financial Product] to achieve [Goal]. Would you like a [better/cheaper/faster] option?

- A mutual friend, [Friend First Name], mentioned that you were trying to [Goal], and they recommended that I get in touch with you. How can I help?

SMS Autoresponder Templates

- Thanks for reaching out to [First Name]. My name is [Salesperson], and I’m a [Title] at [Company]. I’ll get back to you as soon as I’m back at my desk.

- It means a lot that you’ve decided to trust us with [Goals]. Thank you for your trust.

- I just saw that you requested [Lead Magnet]. If you’re interested, I have a 30-, 60-, and 90-day plan that will supplement your download. Interested?

- Thanks for reaching out. Can you answer these six questions? It’ll help us lock in your best rate.

- Rate Drop Alert: You wanted us to let you know when the [Mortgage Rates] drop below [Rate] percent.

Client Updates Re: Changes SMS Templates

- You mentioned wanting to try before you buy, and I’d like to help you set that up. Are you free this [Date/Time]?

- Have you seen the latest [IRS guidelines]? Many of our other clients are upset about it. Here’s why it’s a good thing.

- New [regulatory] changes on the horizon for [small business owners]. That means you.

- Are you concerned about the [changes] updates coming this [Fall]?

- We just got word that [Company] is in trouble. This may affect your [Portfolio] negatively. We’re looking into this and will keep you posted.

Client/Advisor Check-Ins SMS Templates

- So [Company] is offering a new [Product] that can help you hit your milestones faster. Would you like me to send you more information about this?

- Have you seen the latest [IRS guidelines]? I’d like to go over these with you. Are you free on [Date]?

- Did you see the new [regulatory] changes coming this fall? If you’re interested, I’ve got a checklist that will walk you through them.

- Your portfolio just suffered a hit from [Event]. I recommend these three options to help it bounce back.

- We just got word that [Company] is in trouble. The worst thing you can do is make [Bad decision].

Client/Advisor Check-in SMS Templates

- Hi [First Name], my name is [Salesperson], and I’m a [Title] at [Company]. I wanted to introduce myself and offer my help.

- I saw that you were checking out the [Resource] on our website. I wanted to reach out and offer my help. Some details are complicated, but I’m here to help when you need me.

- We put together a plan to help you achieve [Goal] in ##% less time. Would you be available to chat?

- You mentioned using [Financial Product] to achieve [Goal]. Would you like a [better/cheaper/faster] option?

Templates for Client Support via SMS

- [Salesperson] here with [Company]. Can we send you messages about your account? Reply ‘Yes’ if you’d like to receive updates via SMS.

- [First Name], [Salesperson] here. How are things going with [Product/Service] so far?

- [First Name], have you had a chance to go through the onboarding materials I mentioned?

- [First Name], to help you with your questions, I’ll need to redirect your support request to [Department]. Is that okay?

- Thank you for your trust. We’ve enjoyed working with you, [First Name]. Is there anything else I can help you with?

Request/Offer Feedback via SMS

- [First Name], How do you feel about the direction [Compay] is headed?

- So I’ve got a weird question to ask [First Name]. Did we make you happy?

- [First Name], what do you think we could have/should have done better?

- Other clients mentioned they want us to anticipate their needs. Do you feel we’re meeting your expectations there?

- [First Name], what can we do better? I’d like to make sure we’re taking care of you.

These templates aren’t comprehensive. They’re intended to be a helpful starting point. Customize these templates or create your own—work to identify what works for your financial organization.

Step 4: Follow-up With SMS Messaging

Remember the email stats we looked at earlier? As we’ve seen, email is becoming more popular, especially with younger generations. What does this mean?

You continue to use email in your sales outreach campaigns. You focus your attention on building sales outreach campaigns that include the following five phases:

- Indoctrination: In this phase, you offer introductions, set expectations, list the benefits, earn micro-commitments, and create curiosity loops.

- Engagement: This phase is all about selling. You create value via education and use this to move clients toward the outcomes they’re already interested in.

- Ascension: For every offer you make, a percentage of your clients would buy more. Ascension is about maximizing the upsell.

- Segmentation: This phase helps you determine which offer to make to your subscribers. It is all about making the right offer to the right client at the right time.

- Re-engagement: This phase is all about your messages reaching your most loyal, most engaged subscribers/clients. It involves reconnecting with those interested and removing those with little to no engagement.

This is why SMS sales outreach is so valuable. And combining your SMS and email campaigns means it’s easier for you to accomplish specific goals:

- Priming subscribers, prospects, and clients to expect value.

- Solving small problems for subscribers, prospects, and clients—and solving bigger and bigger problems for your clients.

- Creating personalized education, service, and support specific to each client.

- Bringing disengaged subscribers and clients back into the fold.

Why is it easier? We all carry our mobile devices with us. We check our phones constantly, and our response rates are much higher with mobile.

This means we can (a.) lead with value, (b.) earn their attention, and (c.) drive traffic to your emails and landing pages.

Step 5: Analyze and Improve Your SMS Sales Strategy

You’ll need an SMS and CRM platform that can track the metrics that matter most. Which SMS metrics should you focus on for your financial services firm? Here are some options.

- Opt-in and opt-out rates

- Open rates (individual + aggregate)

- Click-through rates (CTR)

- Conversion rates

- Response rates

Imagine that you have a team of five to ten salespeople, each sending out 30 – 50 SMS messages daily. These are very low numbers, but they’re still a significant number of messages from which you can gather data.

If you integrate your SMS effort with a CRM solution, like Pipeline CRM, you can easily analyze the conversion and response rates of your sales outreach messages. Not only that, our lead data management system also helps you segment the customer based on specific factors, allowing you to craft effective SMS outreach campaigns.

SMS and Integrated CRM Solution: A Must-Have for Financial Services Sales Outreach

Most consumers expect their financial institutions to “anticipate their needs.” However, clients hate high-pressure sales; it’s an immediate turn-off, and this approach creates negative outcomes.

An SMS sales strategy can be the bridge. It is the missing piece you need to close more deals.

Your clients prefer to use apps already on their phones, but they’re also using email. It’s not either/or; it’s both. If you’re using a sales CRM for professional services, email, SMS, and CRM integration is an absolute must. It’s a simple way to keep the open, click-through, conversion, and response rates of your sales outreach effort high.

Check out other guides for improving sales outreach, such as follow-up email templates and cold prospecting email templates.