Insurance brokers are operating in one of the most competitive sales environments today. Rising acquisition costs, shrinking commissions, and increasing client churn make it harder than ever to grow an insurance book of business.

Without the right systems in place, insurance agents struggle to manage thousands of policies, track renewals, stay compliant, and deliver the level of service modern clients expect. That’s why more agencies are turning to insurance broker CRM software to centralize data, automate workflows, and protect long-term revenue.

In this guide, we break down the best CRM software for insurance brokers and agents, starting with Pipeline CRM, to help you manage leads, policies, renewals, and client relationships more efficiently.

Why Insurance Agents Need an Insurance CRM to Stay Competitive

Insurance brokers face intense pressure from rising acquisition costs, aggressive competitors, and constant client churn. When a single click can cost $54 or more, losing leads or failing to follow up isn’t just inefficient—it’s expensive.

Managing thousands of policies, renewals, and client touchpoints without a CRM leads to missed opportunities, compliance risks, and stalled growth. A modern insurance broker CRM helps centralize data, automate follow-ups, and create repeatable sales processes, so growth doesn’t turn into survival mode.

TL;DR: Best CRM Software Tools for Insurance Brokers

We’ve done the research for you. Here are the top five CRMs for Insurance Brokers and their best use cases:

- Pipeline CRM: best insurance CRM software for revenue and sales-driven brokers.

- AgencyBloc: best insurance CRM software for health, senior, and benefits agencies.

- EZLynx: best CRM software for all-in-one agency management.

- Insureio: best CRM software for insurance case management.

- Insightly: best CRM for all-in-one marketing software.

We’ll provide a detailed breakdown, including features, pros and cons, reviews, and pricing for each CRM. Let’s get started!

Pipeline CRM: Best Insurance CRM for Revenue and Sales-Driven Agents

Pipeline CRM is built for insurance agents and brokers who need to manage long sales cycles, high lead volumes, renewals, and repeat business—all while staying focused on revenue. Unlike other CRMs for insurance companies, Pipeline CRM supports the real insurance sales process: capturing leads, qualifying prospects, tracking policies through multiple stages, closing faster, and retaining clients over time.

For insurance brokers managing hundreds or thousands of accounts, Pipeline CRM makes it easy to prioritize the right opportunities. Agents can track every sales opportunity (from first inquiry to signed policy) while keeping notes, documents, emails, and follow-ups tied to each client. This helps insurance teams stay organized, respond faster, and avoid losing high-value prospects due to missed follow-ups or manual processes.

Pipeline’s insurance CRM also supports team-based selling common in insurance agencies. Managers get full visibility into pipeline health and expected revenue, while agents know exactly which leads, renewals, or upsell opportunities need attention each day.

Features That Make Pipeline CRM the Best Insurance CRM

- Sales automation to trigger follow-ups, reminders, and next steps across the insurance sales cycle

- Customizable sales pipelines and deal stages to match insurance workflows (quotes sent, underwriting, policy issued, renewal pending)

- Built-in lead generation forms to capture inbound insurance leads and route them automatically to agents

- Built-in eSign to send policies, applications, and agreements for digital signature and close deals faster

Why Insurance Brokers Choose Pipeline CRM

- Designed specifically for revenue-focused sales teams, not generic contact management

- Flexible pipelines that adapt to insurance-specific sales and renewal processes

- Scales easily from solo insurance agents to growing brokerages

- Easy to use, fast to implement, and supported by responsive customer support

- A CRM with rich integration options, such as with QuickBooks, Asana, Mailchimp, and CallRail.

Reviews of Pipeline CRM

- 4/5 star rating on G2 (938 reviews total).

- 3/5 star rating on Capterra (624 reviews total).

- 7/10 score via TrustRadius.

- 2/5 star rating via Gartner (42 reviews total).

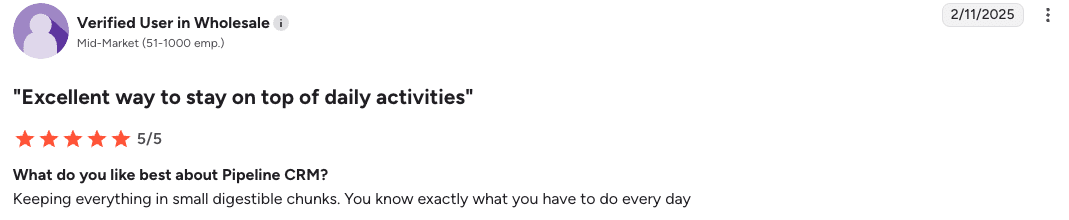

Here’s a Pipeline CRM user review on G2:

“Excellent way to stay on top of daily activities”

What do you like best about Pipeline CRM?

Keeping everything in small digestible chunks. You know exactly what you have to do every day.

Pipeline Pricing

- Start plan: $29 per user/mo.

- Develop plan: $39 per user/mo.

- Grow plan: $59 per user/mo.

Learn more about Pipeline CRM’s pricing plan and features.

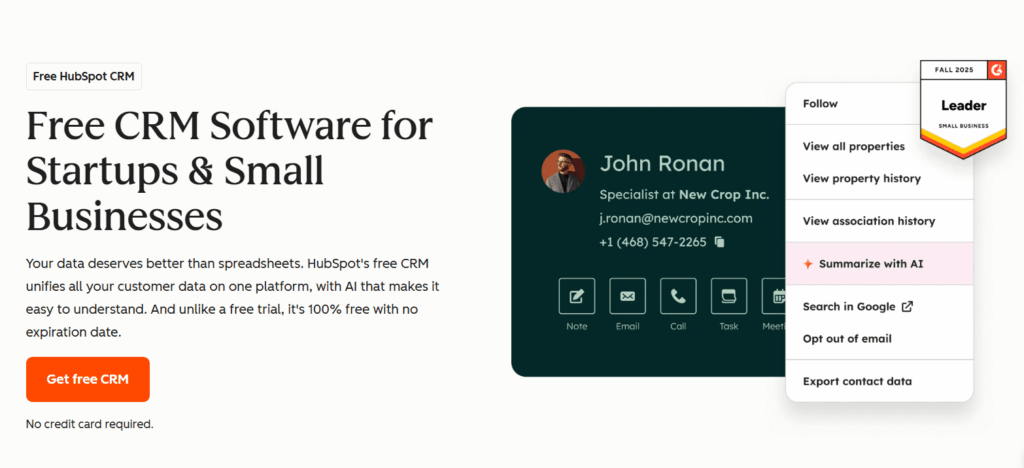

HubSpot CRM: Best for Insurance Prospect Research and Outreach

HubSpot CRM is a strong option for insurance teams that focus on inbound lead generation and high-volume outreach. It helps agents identify high-intent prospects and engage them at scale using personalized email sequences and automated follow-ups—useful for quoting campaigns, policy promotions, and renewal reminders.

The platform enriches contact records with publicly available data and tracks engagement signals such as email opens, link clicks, and website visits. For insurance agents, this makes it easier to spot prospects researching coverage options or returning to quote pages, indicating potential purchase readiness.

HubSpot also includes built-in landing pages and lead capture forms, allowing insurance teams to collect leads directly from marketing campaigns. Features like form shortening and progressive profiling help reduce friction for prospects while still capturing the data agents need to qualify leads and move them into the sales pipeline.

HubSpot CRM Features at a Glance

- Lead and deal scoring tools let you know which prospects are most likely to convert into customers and which ongoing deals have the highest closing potential.

- HubSpot also offers tools dedicated to marketing and customer service, which allow you to centralize customer data from multiple departments for hyper-targeted sales campaigns.

- Invoicing and payment processing are possible directly within the platform.

- Ensure accurate prospect data through automatic database enrichment and duplicate management.

- Built-in meeting scheduler and an omnichannel inbox help you stay in touch with prospects on their preferred communication methods.

HubSpot CRM: Pros and Cons

- Clean user interface that prioritizes ease-of-use and navigation.

- Access to a massive integration library through HubSpot’s app marketplace, and the option to connect the CRM with all the other HubSpot products.

- Report customization may be slightly underwhelming for more data-oriented users.

- Pricing differences between paid packages are rather steep.

HubSpot Reviews

- 4.4/5 star rating in G2 (13,083 reviews)

- 4.5/5 star rating in Capterra (490 reviews)

- 8.9/10 star rating in Trust Radius (551 reviews and ratings)

HubSpot CRM Pricing

- Smart CRM Starter: $15 per user per month

- Smart CRM Professional: $50 per user per month

- Smart CRM Enterprise: $75 per user per month

- Sales Hub Starter: $15 per user per month

- Sales Hub Professional: $100 per user per month

- Sales Hub Enterprise: $150 per user per month

AgencyBloc: Best Insurance CRM Software for Health, Senior, and Benefits Agencies

AgencyBloc is an agency management system. If you’re in the health, senior, or benefits space, AgencyBloc is a comprehensive solution offering a range of insurance-specific solutions for sales enablement, client and policy management, compliance management, quoting and proposals, commissions management, and more.

AgencyBloc Features at a Glance

- With AgencyBloc, you can track commissions for all agents and clients.

- Keep track of client policies, account status, renewal dates, and commissions distributed so far.

- Agents can set alerts for important to-dos (e.g., policy renewals, commissions, client reminders, etc.).

- 24/7 support via phone, email, or live chat.

- Easily sync with other CRM systems if you don’t want to use AgencyBloc’s CRM.

AgencyBloc: Pros and Cons

- Excellent customer service.

- Highly recommended by current customers.

- AgencyBloc comes with a free trial.

- There’s no freemium plan.

- No premium consulting or add-ons.

- AgencyBloc takes time to set up.

AgencyBloc Reviews

- 6/5 star rating on G2 (41 reviews total)

- 8/5 star rating on Capterra (130 reviews total)

- 9/10 score via TrustRadius

- 8/5 star rating via GetApp (130 reviews total)

AgencyBloc Pricing

- $109 per mo.

- Setup fee (Call for quote).

- Contact for a quote.

EZLynx: Best CRM Software for All-in-One Agency Management

EZLynx is an all-in-one Insurance CRM Software for startups and small businesses. They have 37,000 customers in 48 states. One thing that sets EZLynx apart is their Rater Engine, a comparative rater that allows agents “to enter an applicant’s data once and then send out quotes to multiple carriers. Those carriers then submit their quotes back to the agency, and the agency can then share them with their customer and recommend which one provides the best coverage at the right price.”

EZLynx’s all-in-one agency management software enables agents to obtain quotes for personal and commercial lines of insurance. Even better, it’s integrated into their entire platform, which is the platform’s strongest selling point.

EZLynx Features at a Glance

- Quotes/estimates management.

- Customer portal and account dashboard where customers can communicate directly with agents.

- Document signing is built into their platform.

- Commission management.

EZLynx: Pros and Cons

- EZLynx offers premium features at no cost.

- Their comparative rater integrates with most carriers.

- Customers prefer live support over email or support tickets.

- Reporting is not as robust as native.

EZLynx Reviews

- 2/5 star rating on G2 (319 reviews total).

- 7/5 star rating on Capterra (68 reviews total).

- 8/10 score via TrustRadius.

- 5/5 star rating via Gartner.

EZLynx Pricing

- Contact for a quote.

- Estimates are $200 per mo./seat.

Insureio: Best CRM Software for Life Insurance Case Management

Insureio is an email-heavy CMS that agents can integrate with their email marketing platforms to create targeted campaigns and track engagement. According to customers, one thing that stands out about Insureio is the software’s ease of use. Customers repeatedly mention the ease of use and simplicity of their platform.

Insureio takes things further by providing insurance agents with pre-built marketing templates and campaigns they can customize for their business. They make up for what they lack in features, sophistication, or integrations with simplicity, ease of use, and customer support.

With Insureio, agents can generate quotes for term life, whole life, long-term care (LTC), disability, and annuities coverage from over 40 carriers.

Insureio Features at a Glance

- A client portal where customers can view policy details, upload documents, and communicate directly with agents.

- Policy management tools provide customers with detailed policy information, including coverage details and renewal dates, all in one place.

- The Insureio platform integrates directly with insurance carriers for real-time updates and policy processing.

- Helps agents maintain compliance standards with built-in tracking and documentation features.

Insureio: Pros and Cons

- Built-in compliance tracking means compliance with industry regulations is semi-automated.

- Offers pre-built workflows that automate routine tasks such as sending reminders and follow-up emails.

- Lacks the extensive third-party integrations needed for agents to work with tools and providers they’re already using.

- Limited customization options: Insureio’s simplicity means you have fewer customization and flexibility options available to tailor the platform to your specific workflows and processes.

Insureio Pricing

- Basic: $25 per mo.

- Marketing: $50 per mo.

- Agency Management: $50 per mo.

- Marketing + Agency Management: $75 per mo.

Insightly: Best CRM Software for All-In-One Marketing Software

Insightly is a popular option with small-to-medium-sized companies. Recently acquired by Unbounce, Insightly enables insurance agents to manage all aspects of their sales and marketing campaigns. Agents can manage their sales pipelines via Insightly’s CRM.

They can set up marketing automation campaigns, create list segmentation, manage email marketing, design landing pages, conduct A/B split testing, and optimize your marketing campaigns. Then there’s customer support. With Insightly, your agents and support teams can manage live chats and messaging, support tickets, knowledgebases, and support/customer portals.

If you’re looking for an affordable, all-in-one option that’s not directly tied to the insurance industry, Insightly may be a good fit for your agency.

Insightly Features at a Glance

- Streamlines territory, workflow, and channel partnership management through automation.

- Provides a wide range of third-party tools and services, such as marketing platforms, accounting software, and data services through native integrations.

- Calculated fields reduce manual work and minimize errors by using formulas for complex calculations on any object.

- Their Opportunity Conversion feature helps convert won opportunities into projects.

- Enhance accuracy in data entry and automation execution with custom validation rules.

Insightly: Pros and Cons

- Insightly centralizes all your customer data—giving your agency a comprehensive view of every customer relationship.

- Many customization options and automation allow you to customize Insightly’s platform to work the way you need it to.

- Affordable pricing options that scale with your Insurance agency as you grow.

- Fewer third-party integrations than their competitors.

- A steep learning curve for new users, especially if you’re looking for a simple and easy-to-use solution.

- Role-based permissions aren’t as robust as their competitors.

Insightly Reviews

- 2/5 star rating on G2 (920 reviews total).

- 0/5 star rating on Capterra (660 reviews total).

- 9/10 score via TrustRadius (824 reviews total).

- 4/5 star rating via TrustPilot (7 reviews total).

Insightly CRM Pricing

- Plus: $29 per user/mo.

- Professional: $49 per user/mo.

- Enterprise: $99 per user/mo.

Marketing Automation and Customer Support products are priced separately. If you want each of their products and services to share data, you’ll also need to pay for Insightly’s AppConnect.

How Does CRM Software Help Your Insurance Agency?

Your insurance agency must win three key daily battles to grow and make an impact:

1. Attract and Convert a Consistent Stream of Prospects

You’ll need to identify your breakeven cost—the most you can spend to win a new client without incurring a loss. Once you have that, use the data gathered by your CRM to acquire more customers at below-breakeven cost.

2. Maintain a 90% Customer Retention Rate

Use your CRM software to improve your customer support; set up reporting on key metrics and KPIs to track the performance of your sales and service teams. Use this data and your CRM to improve your customer retention rate.

3. Increase Purchase Frequency

Solve more problems for your existing customers, and you increase your purchase frequency. The better you are at increasing purchase frequency, the more dependent your customers will be on your agency.

You can use nontraditional approaches to do this, but each of these depends on the relationships you build with your prospects and customers. Every interaction you have with a prospect or customer should create value. The more value you make, the easier it is to attract, convert, and retain your customers.

The Insurance Business Is Brutal—But You’re Built for It

You already know that the insurance industry is fiercely competitive, tightly regulated, and constantly shifting. Customers move on. Rates change. Markets evolve. And if your agency isn’t growing, it’s shrinking.

But here’s the good news—growth is possible, and it’s within reach.

The most successful agencies focus relentlessly on the Four Ps: People, Product, Process, and Performance. And the easiest way to bring all four under control? A powerful insurance CRM that turns strategy into action.

With the right CRM system, your agency can streamline sales workflows, improve customer experience, and maximize every lead. You’ll boost client retention, speed up your close rates, and empower your producers to win more high-quality business.

Boost Insurance Sales by 15–50% with Pipeline CRM

Pipeline CRM is built for growth-focused agencies. It’s not just another tool—it’s your sales enablement engine.

Join over 18,000 companies using Pipeline to shorten sales cycles, improve team performance, and close more policies with less effort. If you’re ready to improve insurance sales performance and drive real growth, Pipeline is ready to help.

Compare plans and pricing and start scaling smarter.

FAQs about Insurance CRM, Pipeline CRM, and Insurance Sales

What Is the Best CRM for Insurance Brokers?

The best CRM for insurance brokers is Pipeline CRM because it supports the full insurance sales process, including lead management, customizable deal stages, follow-ups, and eSign—helping insurance agents manage policies, renewals, and revenue in one system.

How Does a CRM Help Insurance Agents Close More Policies?

A CRM helps insurance agents close more policies by organizing leads, automating follow-ups, tracking sales opportunities, and keeping all client communication in one place. Tools like Pipeline CRM help agents focus on the right prospects at the right time.

What Features Should an Insurance CRM Include?

An insurance CRM should include sales automation, customizable pipelines for insurance stages, lead capture forms, document management, and eSign. Pipeline CRM combines these features to support quoting, policy issuance, and renewals efficiently.

Is Pipeline CRM a Good CRM for Insurance Agents?

Yes, Pipeline CRM is a good CRM for insurance agents because it is designed for revenue-driven sales teams and offers flexible pipelines, automation, lead management, and eSign—making it well suited for insurance sales and renewals.

What’s the Difference Between a General CRM and an Insurance CRM?

The difference between a general CRM and an insurance CRM is that an insurance CRM supports longer sales cycles, renewals, compliance-driven follow-ups, and policy-based deal stages. Pipeline CRM can be configured to handle these insurance-specific workflows effectively.